What is a Credit Score?

By Amanda Williams • January 3, 2024

A credit score is a number generated by a mathematical formula that is meant to predict credit worthiness. Credit scores range from 300-850. The higher your score is, the more likely you are to get a loan. The lower your score is, the less likely you are to get a loan. If you have a low credit score and you do manage to get approved for credit then your interest rate will be much higher than someone who had a good credit score and borrowed money. Therefore, having a high credit score can save many thousands of dollars over the life of your mortgage, auto loan, or credit card.

What affects your Credit Score?

By Amanda Williams • January 3, 2024

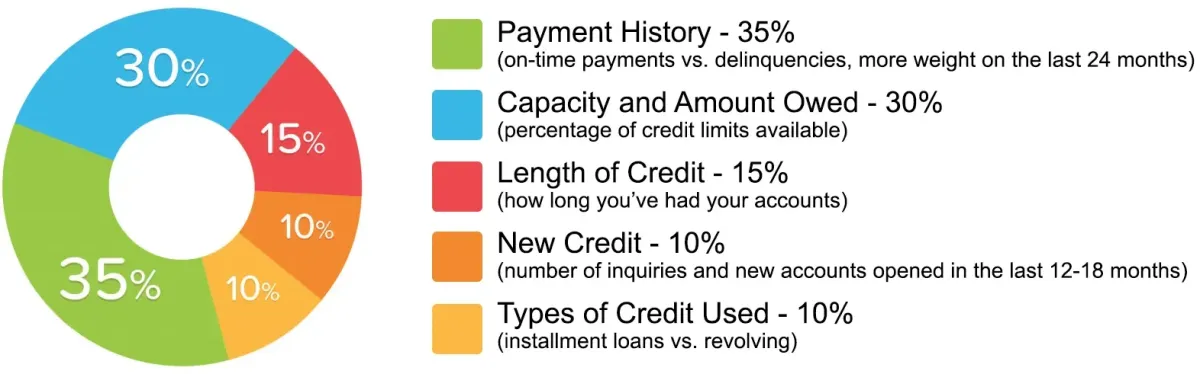

We will help you to dispute negative items in your payment history.

How long will certain items remain on my credit file?

By Amanda Williams • January 3, 2024

How long will certain items remain on my credit file?

FAQ

Is Credit Training legal?

Yes, credit training is legal and our credit education and document processing services will help you to use the law in your favor. That law is called "The Fair Credit Reporting Act." The FCRA gives you the right to dispute any item on your credit report. If that item cannot be verified within a reasonable time (usually 30 days) it must be removed. Studies have shown that 79% of all credit reports contain errors. This is nearly 8 out of 10 reports. Therefore most credit reports improve immediately. For items that disputed that are not errors, a creditor or furnisher is often unable to find the records or signed documents within the allotted time and the item gets removed. Sometimes the furnisher will say it has been verified by not offer proof. It is our job to prepare documents that challenge this and we are very skilled at that.

Is Credit Training and Education worth my time and money?

Contrary to what credit bureaus want you to believe, credit training does work in most circumstances. But it only works if you are getting the best advice from an experienced professional. Anyone with a credit score below 720 can benefit long-term from the advice and information provided through credit education. However, there are limiting factors that will prevent us from helping you. Two main factors are: (1) your financial situation and/or (2) the time frame in which you need to reach your results. It is possible to remove anything from a credit report, even accurate items. For instance, if the creditor makes mistakes or does not adhere to the specific time frame, the negative item may be removed.

What can I expect when I enroll in Credit Education?

We will guide you through the process from start to finish and prepare all your documents for you. We have a superb knowledge of credit scoring and experience working with creditors and credit bureaus. It may be difficult for an individual to communicate with creditors and bureaus without an adept understanding of their techniques and regulations in place for credit reporting. We have spent a great deal of time learning the laws that will help you to remove negative information on your report, which enables us to offer you a flawless, money back guarantee system.

What is your 100% guarantee?

You are entitled to a 100% refund on all monthly payments if:

- You do not remove more than 25% of all the negatives worked on.

- You have had six months from the time you retain our services.

- You have not used a credit-consulting agency nor attempted to repair your credit two years previous to signing up for our services.

- You agree to send updated reports from the three credit bureaus to us within 24 hours of receipt.

(Clients should receive updated credit reports every 15-45 days. It is the client's responsibility to make us aware if updated reports have not been received).

How long will it take to raise my score?

Through our services, some of our clients see their credit score increase 10 points or more in the first 35 days. Over the full 180-day term of the contract, the average credit score increase is 80 points. See full statistical breakdown.

Why are your results different?

There are two sides to the credit score battle. Sometimes, the creditors and the credit bureaus have done absolutely everything right and we have no case against them. On average, clients are able to remove 70% of the negative items from a credit report.

Will the removed items come back?

Items cannot come back as long as the item is current or paid at the time of removal or if the collection is older than three years. This holds true except in very rare circumstances.

What items can you help me to remove and improve?

With our assistance and document processing, our clients have had great success with bankruptcies, foreclosures, collections, charge-offs, repossessions, medical bills, credit card debt, inquiries, late payments, old addresses, judgments, tax liens and student loans.

Guides and tips for YOUR financial management

Financial management is crucial for achieving your financial goals and maintaining overall financial well-being. Here are some guides and tips to help you with financial management:

Create a Budget:

● Make a detailed list of your monthly income and expenses.

● Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., entertainment, dining out).

● Ensure that your income covers your expenses, and allocate some funds for savings.

Emergency Fund:

● Build an emergency fund to cover 3-6 months' worth of living expenses.

● This fund acts as a safety net in case of unexpected expenses or job loss.

Save and Invest:

● Develop a savings plan and set aside a portion of your income for savings.

● Consider investing for long-term financial goals. Diversify your investments to manage risk.

Debt Management:

● Prioritize paying off high-interest debt, such as credit cards, to save money in the long run.

● Create a debt repayment plan and stick to it.

Credit Score Monitoring:

● Regularly check your credit report for errors and monitor your credit score.

● A good credit score is essential for obtaining favorable loan terms.

Educate Yourself:

● Stay informed about personal finance topics and investment options.

● Attend workshops, read books, or follow reputable financial websites for updates.

Seek Professional Advice:

● Consider consulting with a financial advisor for personalized guidance.

● Professionals can provide insights on investment strategies, tax planning, and overall financial health.

Financial Goals:

● Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

● Regularly revisit and adjust your goals as your financial situation evolves.

Remember, financial management is an ongoing process, and developing good habits can lead to long-term financial success. Tailor these tips to your specific situation and consult with financial professionals when necessary.

Mend Financial Services LLC

Important Links

Business Hours

Monday 9:00 am - 5:00 pm

Tuesday 9:00 am - 5:00 pm

Wednesday 9:00 am - 5:00 pm

Thursday 9:00 am - 5:00 pm

Friday 9:00 am - 5:00 pm

Saturday 9:00 am - 12:00 pm

Sunday Closed

© 2025 All Rights Reserved | Mend Financial Services